civic tax relief fresh start program

Active Duty Tax Credit. Childhood obesity legislation enacted in 2013.

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

Browse Google Shopping to find the products youre looking for track compare prices and decide where to buy online or in store.

. Get Real Estate Tax relief. Review and Return Your Information. Jessica Marie Johnsons award-winning and groundbreaking book Wicked Flesh is coming in paperback from Penn Press this fall.

Governor and Secretary of. Under the bill 85 of excess state revenue collected in 2021 will be used for the rebate which. Tax credits for required paid leave by small and midsize businesses.

Set up an Owner-occupied Real Estate Tax payment agreement OOPA Get a nonprofit real estate. States have continued to actively innovate in the area of school nutrition policies by enacting legislation and adopting resolutions that both complement and supplement federal efforts to implement the Healthy Hunger-Free Kids Act of 2010 PL. Low-income senior citizen Real Estate Tax freeze.

APN ATLANTA In our continuing coverage of the upcoming May 24 2022 General Primary Election this article is the second part of our overview of statewide races. Governor Jared Polis signed the bill into law on Monday May 23rd. They knew all along that the election fraud claims were in Bill Barrs words bullshit.

With the recent signing of Senate Bill 233 Colorado taxpayers will be at least 500 mailed to them by the state this September. Set up a Real Estate Tax installment plan. Enroll in the Real Estate Tax deferral program.

111-296 and other policies that make nutritious. Previously part one covered the statewide races for Governor Lt. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally resolved.

Get the Homestead Exemption. Graphic by Adrian Paulette Coleman Atlanta Progressive News. Breaking News Talk radio station.

The Families First Coronavirus Response Act FFCRA signed into law on March 18 2020 provides small and midsize employers refundable tax credits that reimburse them dollar-for. Small Business COVID-19 Relief Grant Program For taxable years beginning on or after January 1 2020 and before January 1 2030 California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. E 2021-182 and the California Small Business COVID-19.

News Talk 980 CKNW Vancouvers News. As part of its COVID-19 response Congress has created several small business relief programs since March 2020. Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent.

Images pursuant to fair use doctrine. Wicked FleshPaperback Coming Soon. Types of Financial Aid.

Metro Vancouver British Columbia. Submit Verification and Tax Information. In general you can save your application at any point by.

Applying for Financial Aid. The Biden administration says it will forgive all remaining federal student debt for former students of the for-profit Corinthian Colleges chain. Under the new action anyone who attended the chain.

Get a property tax abatement. Unearthing personal stories from the archive Wicked Flesh shows how black women used intimacy and kinship to redefine freedom in the eighteenth-century Atlantic world. You will start on the Before You Begin tab that includes some helpful tips for getting around.

Once you have logged in with your email address and password entered your organizations Tax ID and completed the Eligibility Questionnaire you will be directed to the grant application. California Microbusiness COVID-19 Relief Grant For taxable years beginning on or after September 1 2020 and before January 1 2023 California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the California Microbusiness COVID-19 Relief Program that is administered by the Office of Small. Coloradans Receiving Tax Windfall Later this Year.

Check Your Application Status.

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

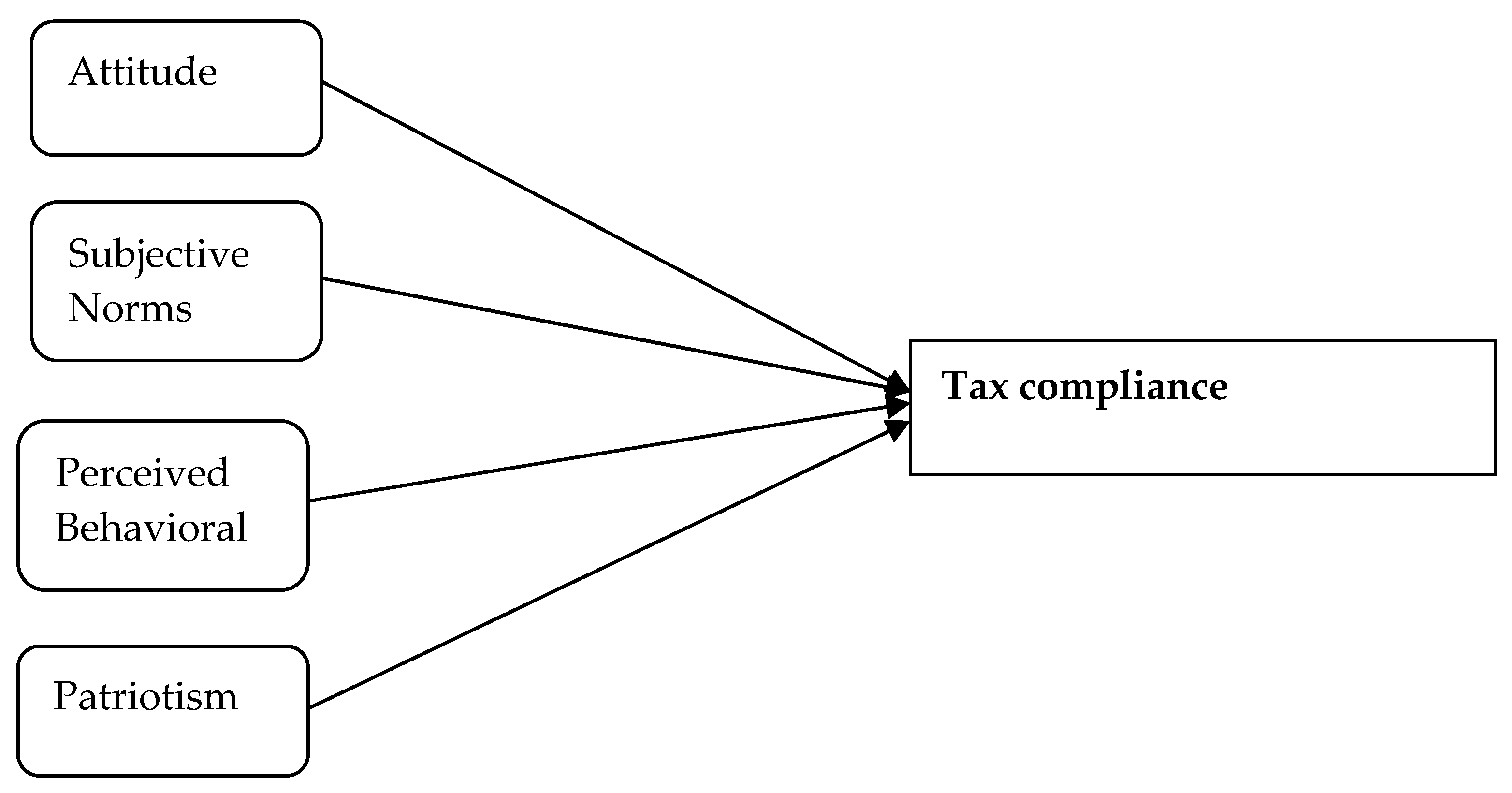

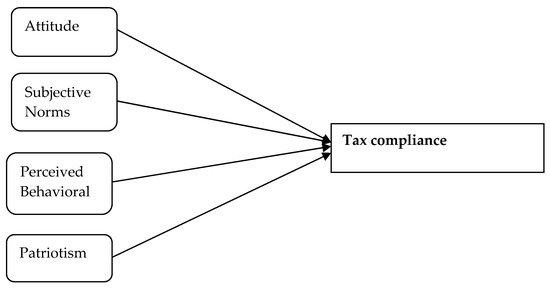

Economies Free Full Text Determinants Of Tax Compliance Intention Among Jordanian Smes A Focus On The Theory Of Planned Behavior Html

Economies Free Full Text Determinants Of Tax Compliance Intention Among Jordanian Smes A Focus On The Theory Of Planned Behavior Html

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

:max_bytes(150000):strip_icc()/precision-tax-400169e3dbd446a1be799052091e9d6e.jpg)

The 7 Best Tax Relief Companies Of 2022

Estimating The Corporate Income Tax Gap In Technical Notes And Manuals Volume 2018 Issue 002 2018

Pdf How To Make The Perfect Citizen Lessons From China S Model Of Social Credit System

Honda Unveils New Civic Hybrid In Europe Civic E Hev Green Car Congress

Honda Civic 1 0 Vtec Review Baby Turbo Hatchback Tested Reviews 2022 Top Gear

Honda Civic 1 0 Vtec Review Baby Turbo Hatchback Tested Reviews 2022 Top Gear

Irs Tax Debt Relief Fast Affordable Professional Civic Tax Relief

Irs Tax Debt Relief Fast Affordable Professional Civic Tax Relief

How To Manage Value Added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020